Frequently Asked Questions

Moving from 11th District COFI to Enterprise COFI Replacement

The Federal Home Loan Bank of San Francisco began publishing the 11th District COFI in 1981. While the index became widely used over time in adjustable rate mortgage loans, the number of eligible reporting bank members needed to calculate the index has recently declined. The FHLB-SF has decided there are too few members to continue publishing the 11th District COFI.

There will be no further publication of monthly 11th District COFI after January 31, 2022, and no further publication of the semiannual 11th District COFI after February 15, 2022.

The Enterprise 11th District COFI Replacement Index (Enterprise COFI Replacement) will be published by Freddie Mac starting on February 28, 2022 (for the January 2022 rate).

The Enterprise COFI Replacement will be comprised of the existing Freddie Mac Federal Cost of Funds Index (Federal COFI) and a spread adjustment (Spread Adjustment). The Spread Adjustment helps to ensure the Enterprise COFI Replacement is comparable to the 11th District COFI.

The Spread Adjustment helps to ensure the Enterprise COFI Replacement is comparable to the 11th District COFI. It consists of two components.

First, it will incorporate the current, i.e., spot, spread between Federal COFI and the 11th District COFI as of February 2022. Second, it will account for the historical spread between the Federal COFI and the 11th District COFI over a 5-year lookback period.

Initially, the spot spread will account for nearly all of the Spread Adjustment, such that when the Enterprise COFI Replacement is first published on February 28, 2022 it will have nearly the same value as the 11th District COFI.

The second component of the Spread Adjustment will be the historical spread between the Federal COFI and the 11th District COFI. Specifically a 5-year median spread will be calculated in February 2022 as the median spread from February 1, 2017 through January 31, 2022. This 5-year median spread will remain fixed once it is calculated in February 2022. As noted, the Spread Adjustment will initially be anchored to the spot spread. Over a twelve month phase-in period, the spot spread will receive less weight, while the 5-year median spread will gradually receive greater weight until it accounts for the entire Spread Adjustment at the end of twelve months.

1. The Enterprise COFI Replacement has been designed to ensure continuity and a smooth transition from the 11th District COFI, and as such is specifically designed to equal each other initially.

2. The Enterprise COFI Replacement will be based on a broad base of actual rate data gathered by the Federal Home Loan Mortgage Corporation, specifically rates on US Treasury bills and notes.

3. The Enterprise COFI Replacement is expected to perform similarly to the index it is replacing, the 11th District COFI.

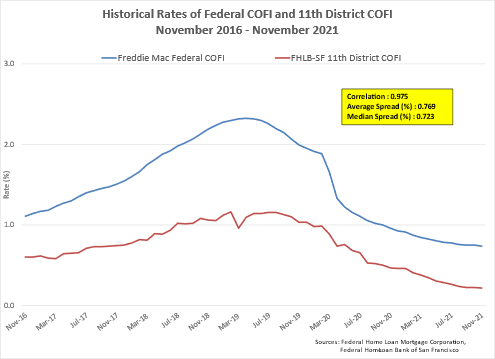

As shown in the chart below, the rates of the Federal COFI (on which the Enterprise COFI Replacement is based) have generally been higher than the 11th District COFI. The Spread Adjustment will help to make the Enterprise COFI Replacement comparable to the 11th District COFI.

In addition, the Federal COFI has historically moved in parallel with the 11th District COFI. As reported in the chart below, from November 2016 to November 2021, the two indexes have a very high statistical correlation of 0.975 (close to the maximum possible correlation value of 1).

The Enterprise COFI Replacement has not been published. The first value will be published on February 28, 2022. The Spread Adjustment will also not be published until sometime in February 2022.

The Enterprise COFI Replacement will be based on a different source of underlying rate data than the 11th District COFI. The 11th District COFI is derived from actual interest expenses paid on borrowed funds by FHLB-SF member institutions. The Enterprise COFI Replacement will be based on the risk-free rates of US Treasury bills and notes, which are the rate data that underly the Federal COFI.

Universal Bank has been in the process of preparing for the conversion to the Enterprise COFI Replacement, but the narrow window of time from first publication date to actual system migration gives borrowers and lenders limited time to respond and incorporate the new rate.

While the new Enterprise COFI Replacement is expected to correlate with the 11th District COFI, the Enterprise COFI Replacement may at times behave differently to the extent the rates underlying the indexes are from different sources. Also as the 11th District COFI will no longer be published and the Enterprise COFI Replacement has yet to be published, actual history and future correlation will not be able to be ascertained (there will never be an overlap period).

Nevertheless, Universal Bank will closely monitor the performance of the new index once publication begins.

Yes. Freddie Mac will also begin publishing on February 28, 2022 an Enterprise 11th District Institutional Replacement Index (Enterprise COFI Institutional Replacement). This index differs from the Enterprise COFI Replacement that Universal Bank will adopt. The only difference is the Spread Adjustment will not include a spot spread component (as does the Enterprise COFI Replacement). As a result, the Enterprise COFI Institutional Replacement will initially differ from the 11th District COFI because its Spread Adjustment will equal the 5-year median spread from day one forward (which is expected to differ from the prevailing spot spread in February 2022).

The Constant Maturity Treasury Rate (CMT). The CMT is reported on a daily and monthly basis and is available in the following tenors: 1, 3 and 6 months; 1, 2, 3, 5, 7, 10, 20 and 30 years. The current and historical CMT rates can be found on the websites of the US Department of Treasury and the Federal Reserve Bank of St Louis. Unlike the Freddie Mac Enterprise COFI Replacement index, which has a built-in Spread Adjustment to ensure comparability with the 11th District COFI, the CMT indexes do not incorporate any spread adjustment.

Another possible rate is the Secured Overnight Finance Rate (SOFR) published daily by the Federal Reserve Bank of New York. The SOFR is an overnight, secured lending rate based on repurchase agreement (Repo) loan transactions collateralized by US Treasury securities. The SOFR does not correlate strongly with the 11th District COFI or Federal COFI.

All banks must cease using the 11th District COFI as a reference rate for any loan product as the index will no longer be published after January 31, 2022.

The FHLB-SF 11th District COFI is based on the actual monthly interest expenses of FHLB-SF member institutions. The index value is calculated as the ratio of total actual interest rate expense to the total amount of borrowed funds (calculated as an average for the current and previous month).

The FHLB-SF has not announced a replacement index nor endorsed any replacement index.

As explained elsewhere in the Q&A, Freddie Mac developed the Enterprise COFI Replacement in large part to fill the gap due to the discontinuation of the 11th District COFI. For example, the replacement index will account for differences in spreads between the two indexes.

The 11th District COFI and Enterprise COFI Replacement are based on different sources of rate data. Specifically, the 11th District COFI is based on FHLB-SF member reported interest expenditures and borrowed funds data. The number of reporting financial institutions has declined such that FHLB-SF has decided to discontinue the index.

The Enterprise COFI Replacement is based on rate information gathered by Freddie Mac for US Treasury bills and notes. The construction of the new index draws from a well-established index used for mortgages, the Federal COFI, and a Spread Adjustment to help ensure the Enterprise COFI Replacement is as comparable as possible to the 11th District COFI.

At Universal Bank, COFI-based loan agreements generally include language that describes the conditions and process for a switch to an alternative benchmark. If such language does not exist, please contact by phone (888) 809 – 8282 or by email at Loanservicedepartment@universalbank.com to discuss an amendment to provide for an alternative benchmark rate.

COFI-based loans with rate reset dates after the February 28, 2022 publication date of the Enterprise COFI Replacement will be subject to the new rate..

You should determine if there is index replacement language already in place. Your loan agreement may contain a section which describes the replacement benchmark if 11th District COFI is unavailable. If you find that the replacement language is not adequate, discuss your options by calling (888) 809 – 8282 or by emailing Loanservicedepartment@universalbank.com.

Universal Bank will provide you with specific information if your loan is affected. In the meantime, if you have questions about your exposure to 11th District COFI and the potential impact of the transition to the Enterprise COFI Replacement, please reach out by calling (888) 809 – 8282 or by emailing Loanservicedepartment@universalbank.com.